The Innermost Way

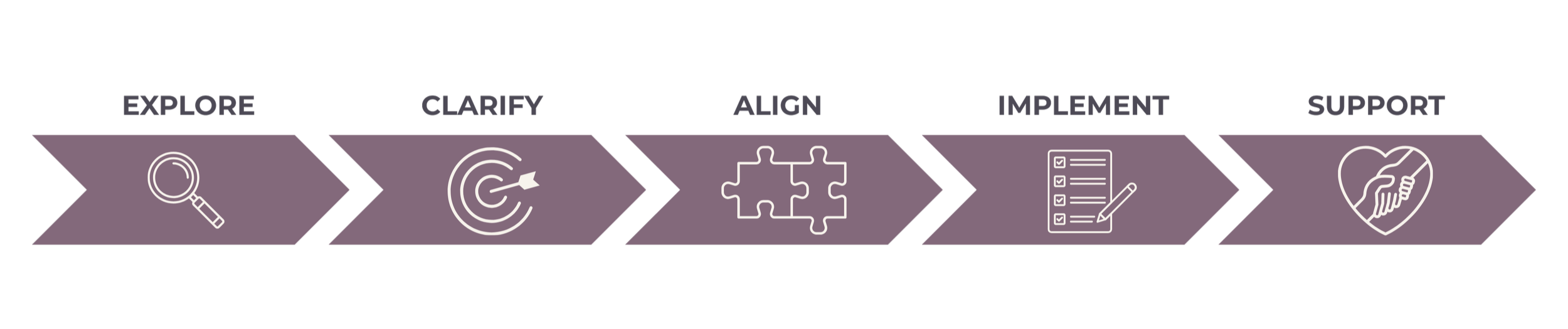

Our work follows a proven, human-centered process designed to adapt to the way real life unfolds.

✦ Our Process

Financial planning is both a science and an art. It requires structure, but also room to breathe. That’s why we anchor our work in the CFP® Board’s trusted 7-step process, then distill it into five intentional phases that are clear, human, and aligned with the way real life unfolds.

✦ Why It Works

We use this structure not only for its thoroughness, but for its compassion. It makes space for complexity, for emotion, and for the deeply human side of financial decision-making. Whether you’re navigating a transition, building toward freedom, or seeking greater grounding with your money, we’ll be with you every step of the way.

BOUTIQUE FINANCIAL PLANNING & INVESTMENT MANAGEMENTWhat Is Included

True wealth management is more than building a portfolio. It is having a trusted partner who understands your life as well as your numbers, anticipates your needs, and guides, coordinates, and advocates for you through every financial season.

At Innermost Wealth Management, we act as your financial concierge and accountability partner, combining deep technical expertise with a highly personalized, relationship-driven experience. We manage the details, keep you on track, and help you move forward with clarity, confidence, and peace of mind.

Your advisory fee includes a fully integrated wealth management experience:

✦ Personalized Investment Strategy

A portfolio designed and managed around your goals, values, time horizon, and risk tolerance, using disciplined, tax-aware, evidence-based strategies. We monitor your investments continuously, make timely adjustments, and ensure every decision supports your broader life plan.

✦ A Living Financial Plan

An evolving strategy that adapts with your life, integrating retirement planning, tax optimization, equity compensation, insurance, estate planning, cash flow, and major transitions. We revisit it proactively so it always reflects your current reality and future vision.

✦ Retirement and Lifestyle Design

Whether you are planning for traditional retirement, early financial independence, or work-optional living, we model multiple scenarios to help you make confident, informed decisions about your future lifestyle.

✦ Equity Compensation and Benefits Guidance

Specialized planning for RSUs, PSUs, ESPPs, stock options, and deferred compensation to help you maximize value, manage concentration risk, and minimize tax impact.

✦ Integrated Tax Strategy

Tax considerations are built into every recommendation. From contribution strategies and tax-loss harvesting to charitable giving and multi-year planning, we ensure your wealth is as tax-efficient as possible.

✦ Insurance Planning

Independent review of your life, disability, health, long-term care, and liability coverage to ensure your protection strategy aligns with your lifestyle and risk profile.

✦ Estate and Legacy Planning

Guidance on wills, trusts, powers of attorney, beneficiary designations, charitable giving, and family legacy planning. We collaborate directly with your attorney or connect you to trusted legal partners for a seamless process.

✦ Cash Flow and Savings Optimization

Values-based budgeting, savings strategies, reserve targets, and debt management to keep your financial life organized, efficient, and aligned with your priorities.

✦ Business Owner & Consulting Support

Guidance for entrepreneurs to align personal and business finances—covering structure, cash flow, retirement plans, and succession. We also offer select consulting on operations and decision-making where money and psychology intersect.

✦ Behavioral and Emotional Guidance

Financial therapy-informed conversations to help you navigate the beliefs, patterns, and emotions that influence money decisions, especially during times of change or uncertainty.

✦ Concierge-Level Coordination

We liaise with your CPA, attorney, insurance agents, and other professionals to ensure every part of your financial life is connected, coordinated, and working toward the same goals.

✦ Ongoing Accountability and Partnership

We do not simply hand you a plan. We walk with you every step of the way. We follow up, check in, and hold you accountable to the goals you have set, making adjustments as your life evolves. When unexpected events occur, you have access to a CERTIFIED FINANCIAL PLANNER® professional who already knows your full story.

COMPREHENSIVE WEALTH MANAGEMENTYour Investment

Partnering with Innermost Wealth Management is an investment that gives you time, clarity, and peace of mind. With a professional guiding your strategy, you gain confidence in your decisions while positioning your wealth to be managed, protected, and thoughtfully grown over time.

Clients choose to work with us because they value objective advice, strategic partnership, and the freedom to focus on what matters most in their lives. Our fees are straightforward and transparent, with no hidden commissions or product sales.

✦ Comprehensive Financial Planning & Investment Management

Our core service is an ongoing partnership that blends portfolio management with holistic financial planning.

We actively manage your investments and guide you through every area of your financial life, including retirement planning, equity compensation, tax strategy, cash flow, estate planning, insurance analysis, and life transitions such as divorce, career shifts, and family planning.

Our annual advisory fee is based on assets under management (AUM) and is structured as listed. Fees are billed quarterly in advance and calculated using a blended tier. For example, a portfolio of $2.5M would be charged 1.00% on the first $2M and 0.75% on the remaining $500K.

✦ Is There a Minimum?

We work best with clients who are ready for a meaningful, ongoing relationship and want to fully leverage our expertise. We partner with those who have at least $820,000 in assets under management or who choose to engage with us at our minimum annual fee of $8,200.

This allows us to dedicate the time, strategy, and proactive care required to address every facet of your financial life with the depth it deserves.

If you’re still building toward that threshold but feel aligned with our philosophy, we invite you to reach out. We are happy to explore whether we’re a good fit or connect you with resources to help you make progress toward your goals.

✦ Project-Based Planning

In certain situations, we offer project-based planning for individuals or families navigating a significant financial decision or life transition who would benefit from our guidance but are not ready for ongoing management.

These engagements are limited in availability and tailored to the scope and complexity of your needs. If you’re interested in exploring a project-based engagement, we invite you to reach out. We’ll review your situation and let you know if it’s a fit, along with a personalized quote.

FINANCIAL SERVICES FOR WOMEN & FAMILIESWho We Serve

We partner with accomplished women and families in defining seasons of life, when identity, relationships, and finances are evolving in profound ways. Our work is tailored for those who value depth, discretion, and a trusted space where every dimension of their financial life is seen, understood, and cared for with intention.

We’re a particularly good fit for:

✦ High-achieving women from executives and entrepreneurs to those navigating equity compensation, complex benefits, and career-defining decisions

✦ Women in or after divorce seeking clarity, advocacy, and confidence in every financial choice

✦ Women balancing wealth and caregiving

✦ Couples and families committed to building wealth aligned to their goals today and the legacy they want to create tomorrow

✦ Widows stepping into new financial responsibilities with grace and confidence

If you’re navigating through transition, carrying significant responsibility, or seeking a trusted, private space to be fully seen and supported in your financial life…You’re in the right place.

Let us guide you to a financial peace of mind.